Not that long ago, blank-check special purpose acquisition companies (SPACs) were all the rage on Wall Street.

In 2020 alone, there were 248 SPAC target IPO deals, with a whopping 613 of them coming the following year.

The market was hot!

How hot was it?

Well, the SPAC market was so blistering back in 2021, that the Wall Street journal did a full review on them titled, “SPACs Are the Stock Market’s Hottest Trend.”[1]

Bloomberg said, “SPACs were hot in 2020 and are hotter now.”[2]

Forbes did a full cover story calling them, “Wall Street’s Money Tree.”[3]

And on February 25, 2021, Jim Cramer, the prognosticator of prognosticators, picked five of them for his audience to invest in (more on this in a moment).[4]

But…

Things have changed. And they’ve changed a lot.

You see, while SPACS were a red-hot money tree back in 2021, recent data shows that the money tree no longer bears fruit, not even for the dealmakers.

Get this… So far this year, there have been just nine SPAC deals. Nine.

That’s a near 99% plummet in dealmaking since the heights of 2021.

But…

Just because the deal flow has slowed dramatically, that doesn’t mean SPACs haven’t been a good investment, right?

Well…

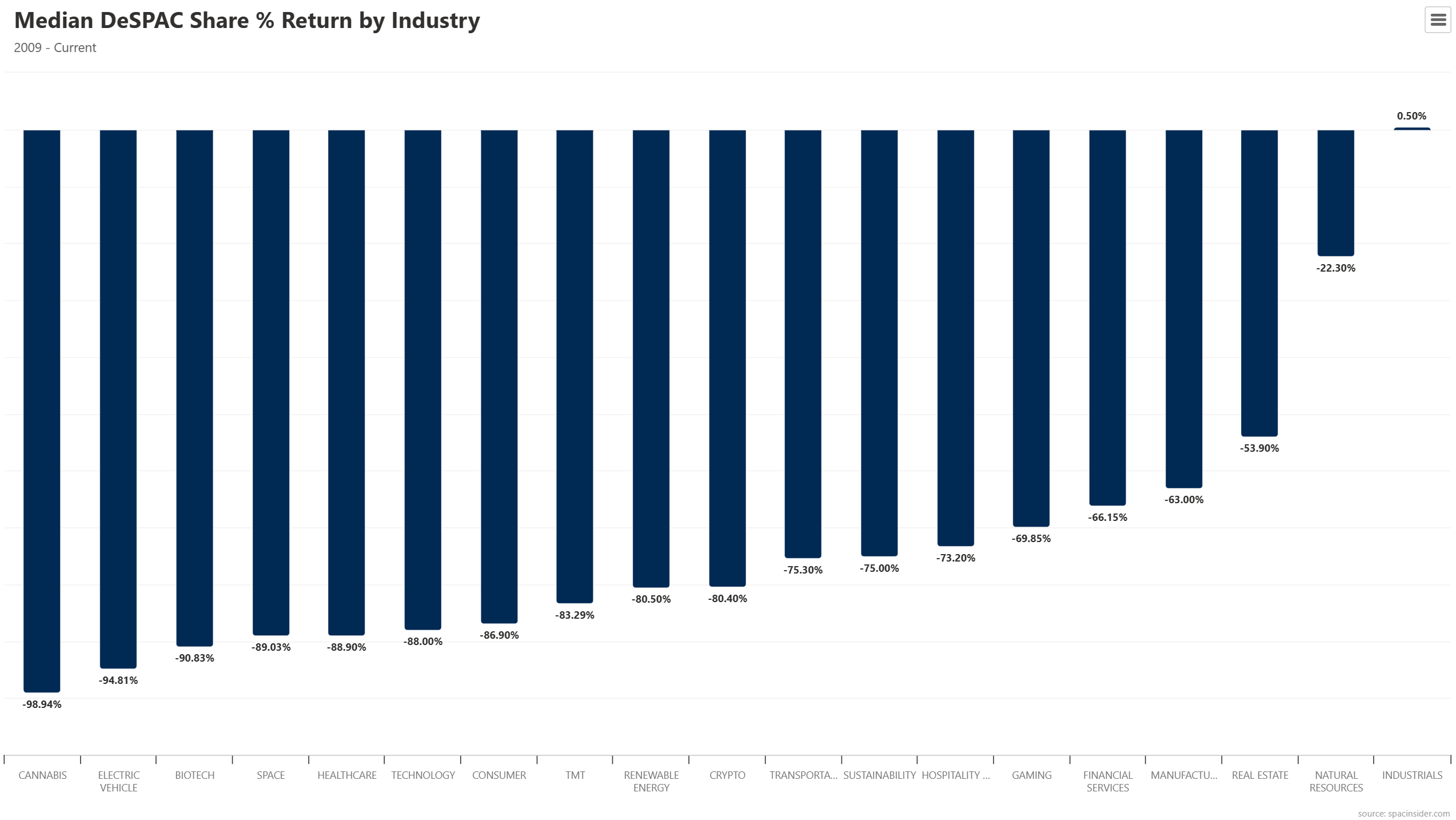

This chart comes to us from our friends over at SpacInsider.com. And it reveals the startling truth about SPACs.

They’ve been, for the most part, a horrible investment.

In fact, since 2009, the only sector with a median positive return has been Industrials, at just 0.5%.

And the worst performing industries? Cannabis and EVs. Down 99% and 95%, respectively.

Of course, there have been and still are some outliers, and actively trading SPACs could have produced, and may still produce decent returns for you…

But as a whole, investing in them for the long-term has been nothing short of horrendous. And the numbers prove it.

Speaking of the long-term…

Let’s have a look back at some of Jim Cramer’s SPAC picks he made for his audience on February 25, 2021, where he said…

“Here’s five new names, because I’m a slave to our viewers.”

Now, of the five picks he so generously shared with his audience, only one is trading higher today. And that’s Vertiv Holdings (VRT).

Vertiv’s stock is now trading (as of this writing) around $88, up from $20 when he made his call. This represents a very robust 340% gain.

But the good news and the good returns end there. And now, you may have guessed it…

His other four picks were bad, really bad!

SoFi (SOFI) went from $20 to its current $7. A 65% drop.

Open Lending (LPRO) went from $39 to $7… an 82% drop.

Skillz (SKLZ) went from $33 to $7, down 79%.

And…

AppHarvest (APPH) went from $33 to being delisted. Yes, delisted.

But let’s be clear, we’re not picking on Jim Cramer. Punching down on him is too easy. We’re simply pointing out how bad of a long-term investment SPACs, as a whole, have been…

And if history is any guide, they may continue to be.

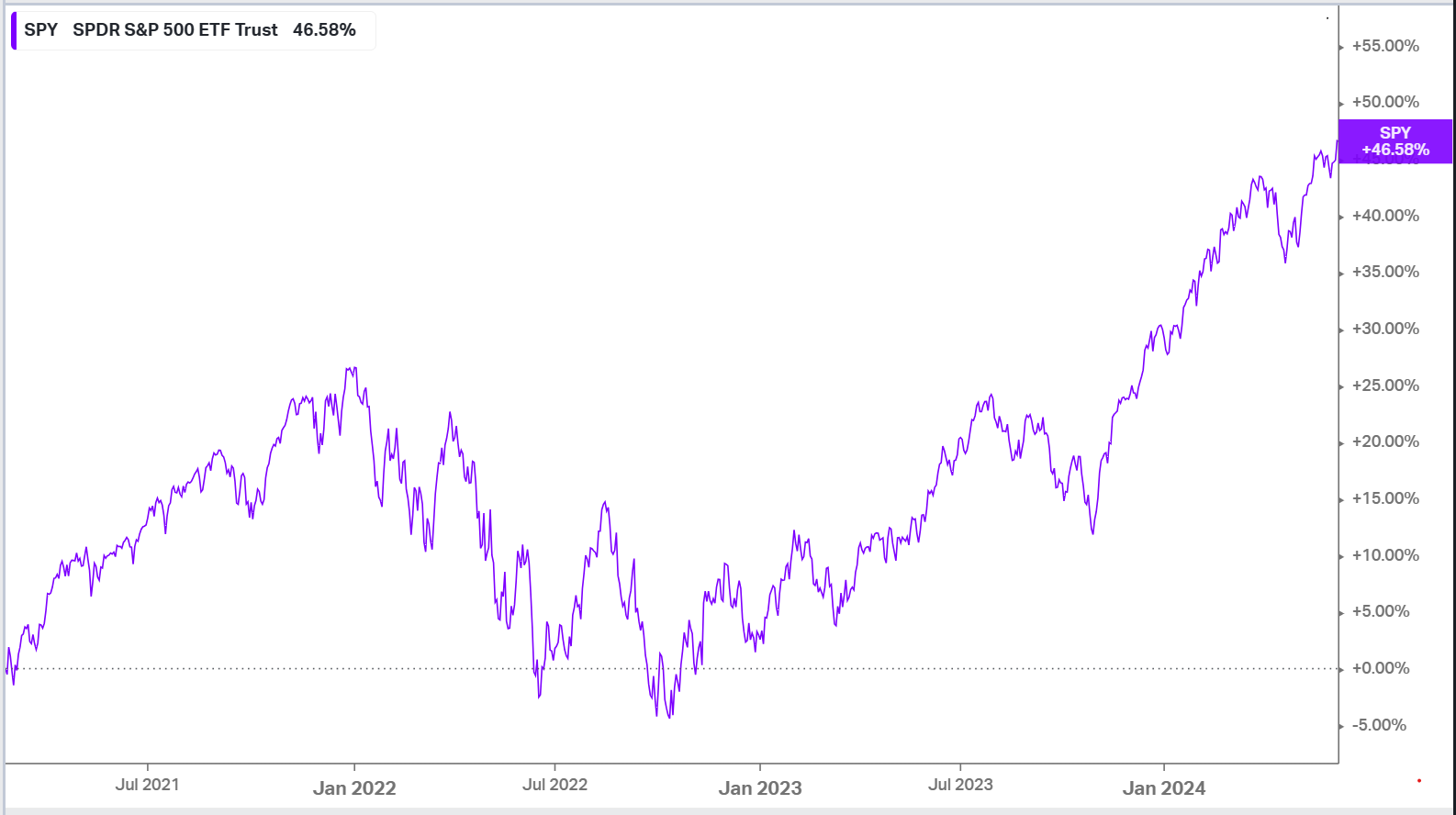

With that said, let’s have a look at this chart, shall we?

This shows the total returns of the SPDR S&P 500 ETF Trust since February 25, 2021. It begins on the same day Cramer made his SPAC picks.

Now, you don’t need to be an eagle-eyed genius to see that simply buying and holding SPY would have been a much better long-term investment than loading the boat with SPACs.

Because, even through the 2022 bear market where the S&P 500 shed 25%, holding SPY would still have resulted in total returns of over 46%.

That’s not bad. And it’s a heck of a lot better than the enormous SPAC losses exemplified by the SpacInsider.com chart.

So, there you have it. Beware of SPACs…

Beware of stock market prognosticators pitching anything that’s “hot” …

Invest your money wisely…

Use proper research…

And apply the tried and true market wisdom (and technology) offered by SentimenTrader.

[1] SPACs Are the Stock Market’s Hottest Trend. Here’s How They Work. – WSJ

[1] SPACs were hot in 2020 and are hotter now. Here’s why | Insights | Bloomberg Professional Services