The platform is renowned for its innovative proprietary research methods. These include the Smart Money Confidence Indicator, which measures institutional investor activity, and the Market Sentiment Optimism Indexes (Optix), which display the current sentiment level for the market in relation to its recent range.

The platform is renowned for its innovative proprietary research methods. These include the Smart Money Confidence Indicator, which measures institutional investor activity, and the Market Sentiment Optimism Indexes (Optix), which display the current sentiment level for the market in relation to its recent range.

SentimenTrader has been a trusted partner for institutional investors, financial advisors, and individual traders for over 20 years.

SentimenTrader is an advanced market research and analysis platform that provides insights into the financial market through a diverse range of tools, reports, and strategies. We assist investors in making informed decisions by analyzing various market indicators.

The platform is renowned for its innovative proprietary research methods. These include the Smart Money Confidence Indicator, which measures institutional investor activity, and the Market Sentiment Optimism Indexes (Optix), which display the current sentiment level for the market in relation to its recent range.

Our research is followed by these media...

Frothy Waters: 3 Yellow Flags for U.S. Equities Emerge

Andrew Rocco, 2024-02-05

In a recent news article published on Yahoo Finance, SentimenTrader’s senior analyst, Jason Goepfert’s observations provide favorable evidence for one of the three warning signs mentioned in the article.

This Is an Unhealthy Bull Market, But What Happens Next?

James “Rev Shark” DePorre, 2024-02-05

In a recent news article published on TheStreet discussing the current state of the stock market, SentimenTrader’s senior analyst, Jason Goepfert, had his views cited as a key source.

Optimism Is Extreme: What Might It Portend?

Michael Lebowitz and Lance Roberts, 2023-12-21

In a recent news article on Real Investment Advice, exploring signs that stock and bond markets may be due for a temporary pullback, Sentimentrader’s analysis and chart were quoted to confirm the prevailing market conditions.

Fluctuating Gold Prices Open Opportunities in 2 ETFs

Ben Hernandez, 2023-12-06

A recent news article on VettaFi, discussing leveraged plays on gold mining stocks, referenced the keen insights of Dean Christians, Senior Analyst at Sentimentrader.

Stock Shopping Spree, Climate Summit: Saturday US Briefing

Virginia Van Natta, 2023-12-02

In a recent news article by Virginia Van Natta on Bloomberg, Jason Goepfert was cited as an expert source to provide analysis on how retail investor behavior could impact the near-term stock market.

Palladium prices are at unsustainable levels - analysts

Jordan Finneseth , 2023-11-15

In a recent piece on Kitco, Jordan Finneseth highlighted the insightful market perspective shared in a recent tweet by Jay Kaeppel.

Gold: False Breakdown Suggests Bull Run Could Be Imminent

Jordan Roy-Byrne, 2023-10-18

In a recent article authored by Jordan Roy-Byrne on Investing.com, Jason Goepfert’s chart provided valuable insights into the gold market.

Market Wallows in Uncertainty as Oil Hits New Highs and Small-Caps Lag

James “Rev Shark” DePorre, 2023-09-19

In a recent article penned by James “Rev Shark” DePorre for RealMoney, SentimenTrader’s analysis shines a spotlight on critical market trends.

How 2023's ‘year of the bond' turned into a furious stock rally unmatched by any in the past quarter-century

Denitsa Tsekova and Bloomberg, 2023-07-31

In a recent Fortune article titled “How 2023’s ‘year of the bond’ turned into a furious stock rally unmatched by any in the past quarter-century,” SentimenTrader is prominently featured as a reliable source for gauging market sentiment.

Gold: Healthy Pullback Provides New Opportunities

Florian Grummes, 2023-03-10

The article “Gold: Healthy Pullback Provides New Opportunities” presents a bullish outlook for gold and discusses the current state of the gold market. The author cites relevant charts from SentimenTrader to support their view, including the Commitments o

Jay Kaeppel: Bear market, this is what has happened historically on Wall Street

Negocios TV, 2022-06-21

Senior Research Analyst Jay Kaeppel talks to Negocios TV about the possibility of a recession. Despite ongoing speculation that a recession is inevitable, Jay says the indicators he follows are neutral.

‘Someone is blowing up' — Bitcoin sees 2022 volume record amid hopes capitulation is over

William Suberg, 2022-05-06

William Suberg compares the futures market to cryptocurrency, which has seen a lot of liquidation, but nothing as drastic or unexpected as in futures. The author considers the conditions required for market capitulation beyond the relatively expected high

‘Buy the Dip' Believers Are Tested by Market's Downward Slide

Gunjan Banerji and Caitlin McCabe, 2022-05-10

WSJ reporters Gunjan Banerji and Caitlin McCabe explore the oft-cited advice to “buy the dip” in light of a continued downward trend in the market. Buyers hoping to capitalize on unusually low-priced stocks are surprised and disappointed to find that they

The Current Market Action Is Wildly Dysfunctional

James “Rev Shark” DePorre, 2024-02-06

In a recent news article published on “TheStreet,” SentimenTrader’s senior analyst, Jason Goepfert’s tweet about the stark contrast in market performance was highlighted.

Are Small Cap Investors Getting Greedy at Important Resistance?

Chris Kimble, 2024-01-03

A recent financial news on Investing.com cited SentimenTrader’s “Extreme Greed” reading, it’s a tool that investors and analysts use to gauge the sentiment of the market.

'Dumb Money' Is Super Confident In Stock Market Right Now: Should We Be Concerned?

Neil Dennis, 2023-12-15

Jason Goepfert, senior analyst at SentimentTrader, was recently quoted in a news story on Benzinga discussing elevated sentiment in the stock market.

Meme-Stock Crowd Plows Into Cross-Asset Rally Lifting Risky Bets

Natalia Kniazhevich and Bailey Lipschultz, 2023-12-02

In a recent news article by Natalia Kniazhevich and Bailey Lipschultz on Bloomberg, Jason Goepfert was directly quoted to provide insight into how retail participation relates to shifts in economic data and institutional versus individual investor sentime

5 Signals Point to a Sustained Bull Market

Andrew Rocco, 2023-11-16

In a recent Yahoo Finance article authored by Andrew Rocco, the research and analysis from Jason Goepfert of SentimenTrader was directly referenced as evidence to support the bull market thesis.

Contrarian Moves: Retail Traders Intensify Market Crash Bets As Put Option Activity Surges

Piero Cingari, 2023-11-07

In a recent article authored by Piero Cingari on Benzinga, the perspective presented in Jason Goepfert’s recent tweet offers valuable market insights.

Tech Stocks Have Led the Market This Year. That Won't Change.

Ben Levisohn, 2023-10-13

In a recent Barron’s article authored by Ben Levisohn, the analysis provided by SentimenTrader brings essential market trends into focus.

China property stocks rally as better news challenges record media negativity

Jamie Chisholm, 2023-09-04

In a recent MarketWatch article authored by Jamie Chisholm, SentimenTrader is prominently featured as a reputable source for gauging market sentiment.

The Market's Positive Signs: Which Way Are We Headed?

Keith Schneider, 2023-07-31

In a recent CNBC article authored by Keith Schneider, he referenced a tweet from our senior analyst, Jay Kaeppel, underscoring that the signs of an impending economic downturn have yet to manifest.

S&P 500 triggers signal with perfect track record for calling end of bear markets

Jeff Cox, 2022-07-20

CNBC’s Jeff Cox looks directly to a timely Tweet by Jason Goepfert in his July 20, 2022 report. He cites Jason’s research as a solid indicator that the bear market is coming to an end. Cox claims the numbers appear to be holding up.

Jay Kaeppel: Could the market react with increases to inflation above 8%?

Negocios TV, 2022-06-07

Senior Research Analyst Jay Kaeppel goes live with Negocios TV, a Spanish-language economic and financial news outlet. Jay is asked about his expectations for the inflation rate in early June and what he’s seeing in investor sentiment.

Opinion: Market newbies got an investing lesson during the pandemic. The cost: losses of $1.1 billion in options trading

Jason Goepfert, 2022-05-09

In a May 9, 2022 opinion piece for MarketWatch, Chief Research Analyst Jason Goepfert argues that, despite mainstream support, the rise of options trading has been an “unmitigated disaster” for traders.

Is There Any Reason to Be Bullish?

Alix Steel and Guy Johnson, 2022-05-18

Senior Research Analyst Jay Kaeppel goes live with hosts Alix Steel and Guy Johnson on Bloomberg TV on May 20, 2022. Jay discusses his optimism, despite many bearish indicators in the market.

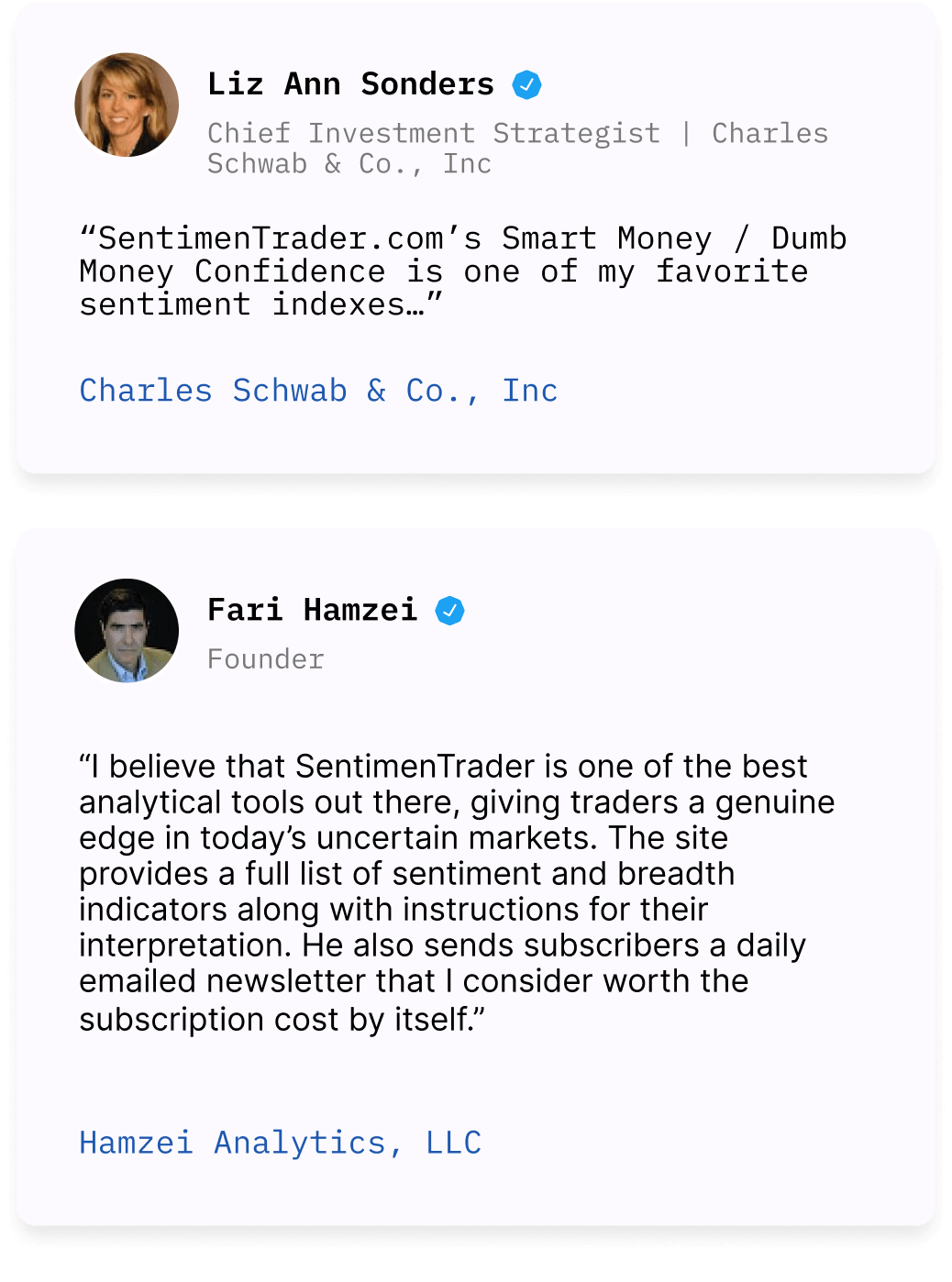

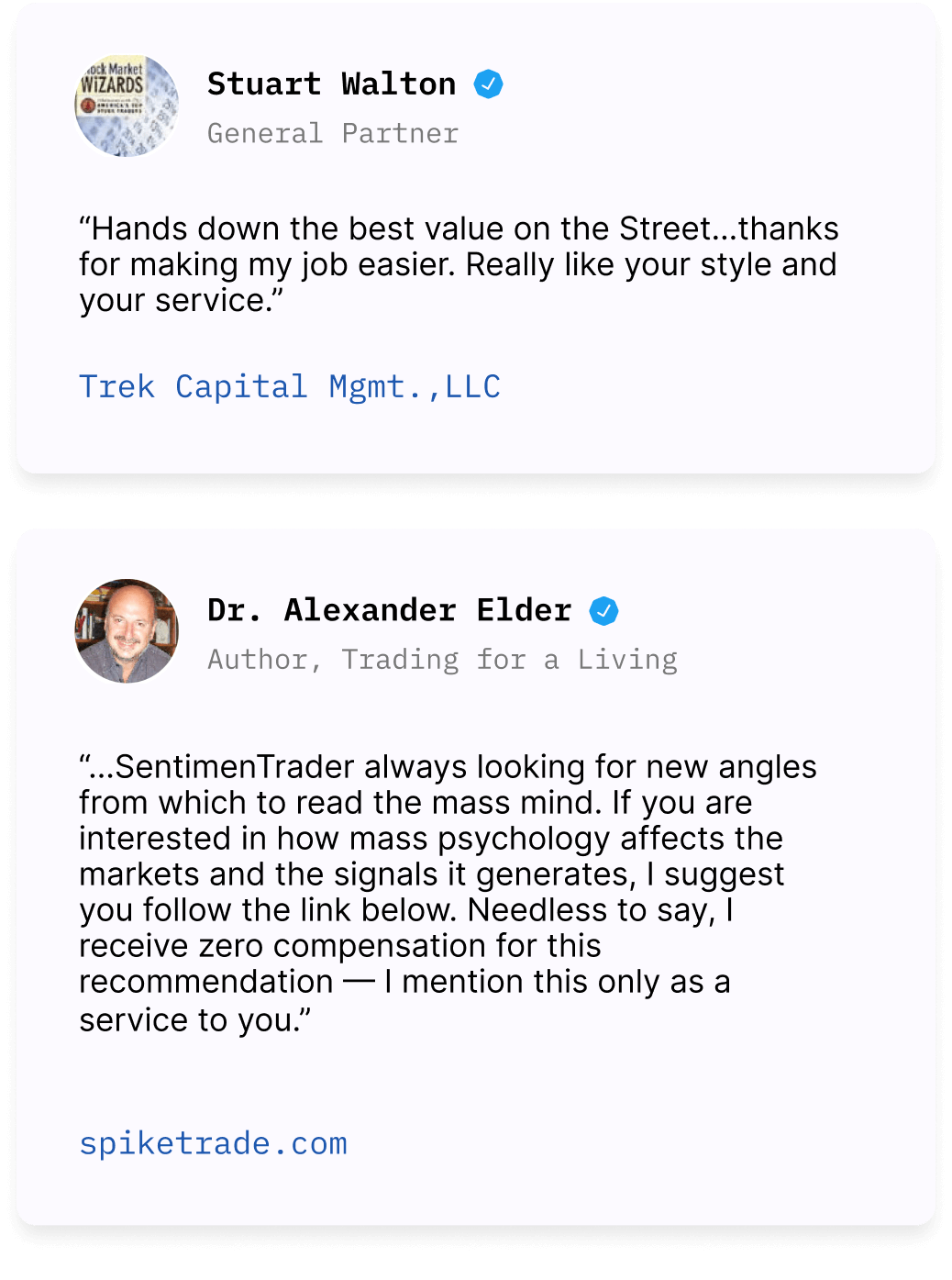

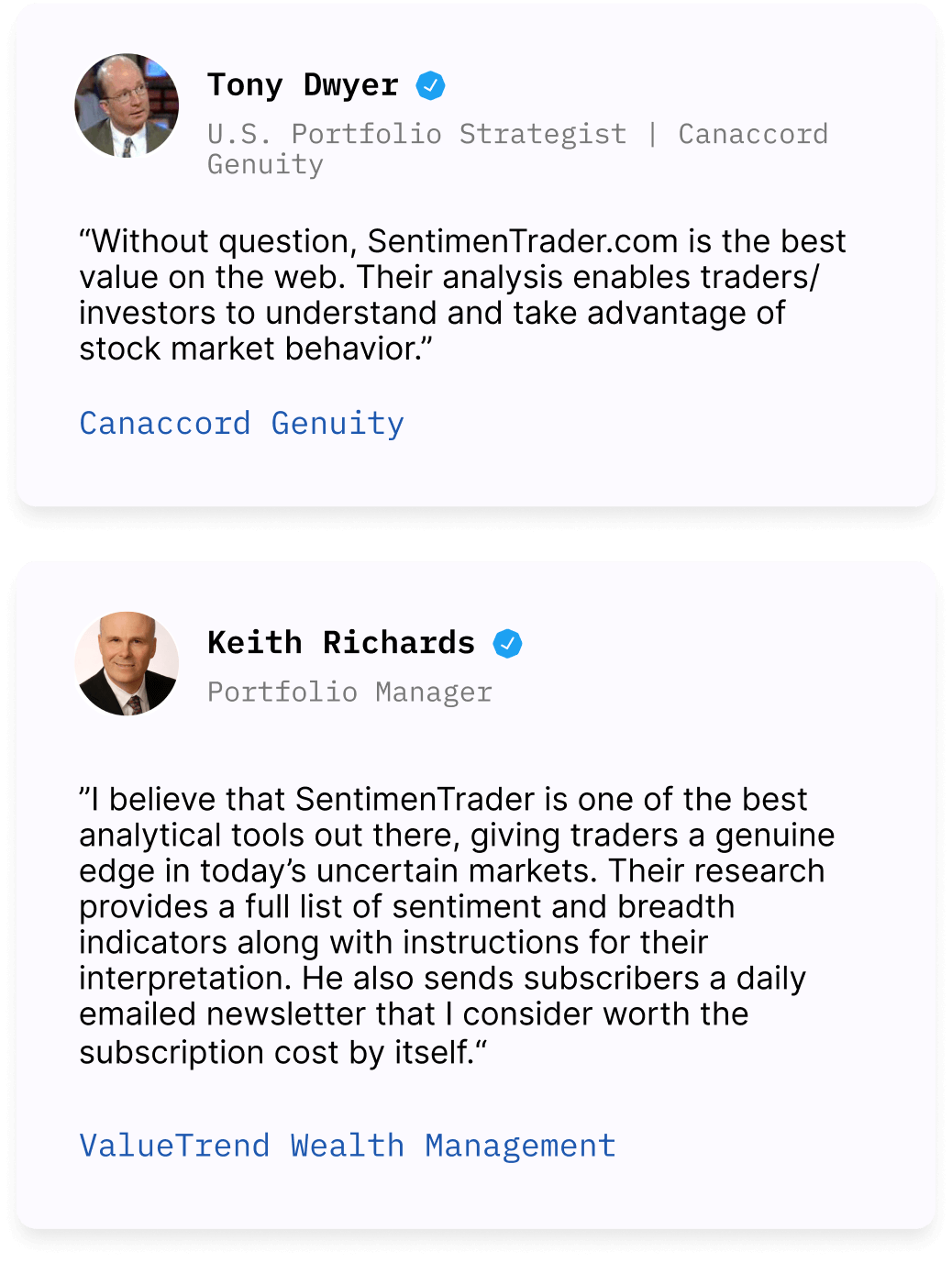

Success Stories from Our Users

Don’t just take our word for it. Hear firsthand how SentimenTrader has empowered traders and investors of all levels. From beginners finding their footing to seasoned professionals seeking an edge, see how our insights have made a difference.