How Much Money Do You Need to Retire? And the Magic of Compound Interest

“It seems to me that all of the things I’ve done leading up to this period were in preparation for what I’m living now.”

This sounds like a quote from a person who has recently retired; is living out their days playing golf, sitting on the docks fishing the days away… or jumping from cruise ship to cruise ship, port to port, doesn’t it?

But the quote continues… “So, it’s rather an enviable spot to be in. I wouldn’t think of retiring.”

That was Betty Reid Soskin, quoted in 2014 when she was 93. Today, Betty is 103 years old… and retired just two years ago as America’s oldest full-time park ranger.

Clearly, we’re not all like Betty Reid Soskin.

In fact, most of us plan on retiring by at least 65, and plan on living an “ideal” lifestyle in retirement.

A recent survey by Provision Living on the “ideal lifestyle in retirement” showed that 34.9% of upcoming retirees wanted to travel, 20.8% said they wanted to spend their time with family and 14.3% said they just wanted to relax.

It should be noted that nobody in the survey said they wanted to work until they’re 100. Like we said, we’re not all Betty Reid Soskin.

But therein lies the issue.

Money.

With the average American now living to 77.5, most of us will have at least a decade of bills to pay, regardless of our “retirement lifestyle.” That’s an average of 12 years of groceries, 12 years of utility bills… 12 years of housing, transportation, healthcare, taxes…

See, your 9-to-5 may come to an end, but the bills never do.

So…

In order to live the life you’ve earned, how much money do you need for retirement?

This is a question you’ve probably asked yourself dozens of times already, and it’s a query that has generated over 1.16 billion page results on Google.

However, the answer to this question is not so simple. We’re all very different, and as the Provision Living survey showed, we all have different goals for retirement.

But let’s make a few assumptions. Let’s assume you’re 45 years old, want to retire at 65, you currently make $100k a year, have no IRA, no 401K and no other retirement vehicles.

Now, most experts agree that you’ll need to have banked between 10 and 12 times your salary when it comes to retirement time. That means anywhere between $1 million and $1.2 million. No easy task, right?

Well…

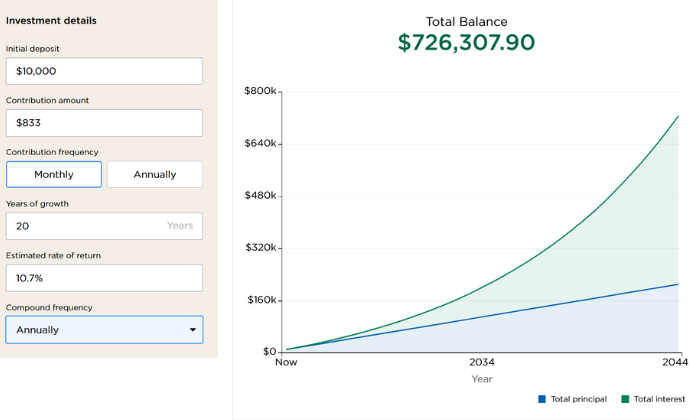

Here’s where compound interest comes in. If you put $10k now, and are capable of putting $833.33 a month into the S&P 500 (and reinvesting dividends), every month from now until you turn 65…

You could be at least half-way there, with around $725k in the market.

That $833 represents 10% of your pre-tax monthly income, and with the historical returns of the S&P 500 being 10.7% a year (over the past 30 years) …

You could be sitting on nearly ¾ of a million dollars.

And if you do have retirement vehicles already in place, are funding them, and you still invest that $833 a month in the S&P, you could be far better off. In fact, you may reach or surpass the goal line.

Now, considering $833 is near the average monthly car payment, this simple monthly investment in your future can really pay off. But what’s better, at 65, you could cash out the entire investment and pay yourself (pre-tax) about $70k a year for a decade (cashing out wouldn’t be wise, but that’s a story for another day).

Of course, all this assumes the S&P 500 continues its 30-year, with dividends reinvested, historical returns.

But you should never assume anything.

You see, although it is wise to be invested in the S&P for the long-term, you should also consider investing a few bucks here and there in single stocks. Stocks that have high upside potential… stock that could turn into long-term, high yielding investments themselves.

But… how can you find them?

Well, while we won’t be giving any individual stock picks in this space, we do suggest you try SentimenTrader’s free simple Backtest calculator.

When you go to the page (HERE), simply input any ticker you believe has, or have heard has potential. Then click “Run and Send Backtest Results.”

Or try the Kelly Calculator. The Simple Kelly Calculator is a tool designed for stock investors to optimize their investment strategy. By inputting your starting capital and win rate, this tool calculates the optimal percentage of your capital to invest in stocks.

Both of these calculators are free.

Now, you may be a rare bird like Betty Reid Soskin and want to work until you’re 100. And that’s fine.

But if you’re like most of us, you should take control over your financial future immediately and consider subscribing to SentimenTrader.