Spice Trade, The Top IPO’s of 2024… And a Preview of What The 2025 Market May Bring

“All the residents of these lands may buy shares in this Company.” As was written in The Dutch East India Company charter on March 20, 1602.

Many regard this simple, twelve word statement as the proclamation that launched modern capitalism. Because with this charter, any qualified citizen of the Dutch Republic, for the first time in history, could invest in a new company, hold shares, trade shares and reap the potential rewards.

Five months after the charter was posted, the spice-trading company went “public”, becoming the world’s very first true IPO.

While it is unknown exactly how many of the 1,143 Dutch citizens who subscribed to the offering became wealthy as a direct result of it (at least two servants subscribed), the company eventually hit a peak valuation of over $8.2 trillion in today’s money…

It was the most valuable company of all time, eight times greater than the peak valuation of Standard Oil. Yes, eight times greater than Standard Oil.

Today, 423 years after the very first initial public offering, investors continue to seek their fortunes in the IPO market.

But until recently, it’s been a rather painstaking process to find quality companies that offer the opportunity of exceedingly solid returns. Or to even find a volume of decent new issues.

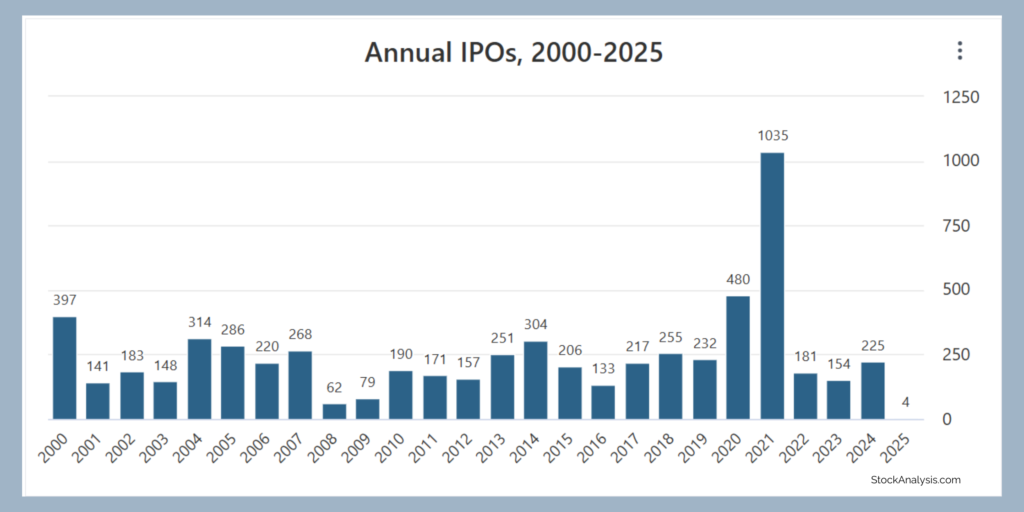

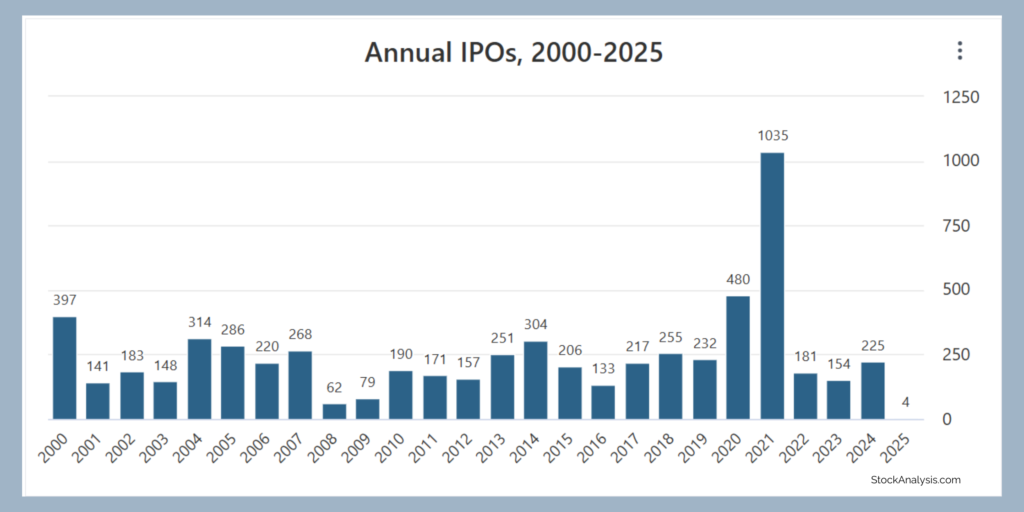

Have a look at this chart…

This shows the annual IPOs in US markets going back to the year 2000. Over the past twenty or so years, the market has averaged about 254 IPOs annually. However, since its peak in 2021, we’ve fallen short of the average, every year.

But…

Even though we’ve been trending below average, 2024 did offer not only an uptick in new issues, but some incredible opportunities as well.

And, as Gareth McCartney, global co-head of equity capital markets at UBS says, the global IPO market is likely to see a resurgence in 2025…

He’s urging participants to “be ready and prepared.”

With that said, and before we get into what may occur in the IPO market this year, let’s have a quick review of some of the biggest IPO winners of 2024, shall we?

Here they are…

The top IPO winners of last year, which have beat the S&P 500’s 25% returns for 2024 (as of this writing) …

CG Oncology, Inc. (CGON): Up 60.3%

ArriVent BioPharma, Inc. (AVBP): Up 49.2%

BrightSpring Health Services, Inc. (BTSG): Up 33.2%

Amer Sports, Inc. (AS): Up 134.8%

American Healthcare REIT, Inc. (AHR): Up 136.1%

BBB Foods Inc. (TBBB): Up 72.0%

Unusual Machines, Inc. (UMAC): Up 209.5%

Astera Labs, Inc. (ALAB): Up 263.3%

Reddit, Inc. (RDDT): Up 405.9%

UL Solutions Inc. (ULS): Up 76.4%

Mingteng International Corporation Inc. (MTEN): Up 43%

Marex Group plc (MRX): Up 71.3%

Loar Holdings Inc. (LOAR): Up 159.6%

Rubrik, Inc. (RBRK): Up 97.5%

Viking Holdings Ltd (VIK): Up 79.4%

NANO Nuclear Energy Inc. (NNE): Up 571%

ZEEKR Intelligent Technology Holdings Ltd. (ZK): Up 35.0%

Super Hi International Holding Ltd. (HDL): Up 36.9%

Bowhead Specialty Holdings Inc. (BOW): Up 87.3%

Waystar Holding Corp. (WAY): Up 74.5%

Recitude Holdings Ltd. (RECT): Up 73.2%

LandBridge Company LLC (LB): Up 323.4%

TWFG, Inc. (TWFG): Up 59.5%

OneStream, Inc. (OS): Up 31.8%

OS Therapies Incorporated (OSTX): Up 28.0%

Legacy Education Inc. (LGCY): Up 108.8%

Guardian Pharmacy Services, Inc. (GRDN): Up 43.7%

BKV Corporation (BKV): Up 32.9%

ZJK Industrial Co., Ltd. (ZJK): Up 86.6%

HomesToLife Ltd (HTLM): Up 71.9%

CeriBell, Inc. (CBLL): Up 35.4%

PTL Limited (PTLE): Up 201.4%

Springview Holdings Ltd. (SPHL): Up 50.0%

Invizyne Technologies, Inc. (IZTC): Up 51.25%

Creative Global Technology Holdings Ltd (CGTL): Up 42.9%

Juniper Neurosciences, Inc. (JUNS): Up 116.25%

zSpace, Inc. (ZSPC): Up 126.8%

ServiceTitan, Inc. (TTAN): Up 40.6%

NetClass Technology Inc. (NTCL): Up 33.8%

Leishcen Energy Holding Co., Ltd. (LSE) Up 27.3%

Health In Tech, Inc. (HIT): Up 37.0%

Now, that’s quite a list of winners… 41 to be exact. 41 IPOs that beat the 2024 returns of the S&P 500. And some, as you see, beat the index quite handily.

So yes, 2024 was, comparatively, a very good year. For some perspective, of the IPOs in 2023, only 18 of them have returned (to date) 25% or better.

Which leads us to 2025 and what could potentially be an even better year. As Gareth McCartney of UBS said, “be ready and prepared.”

With just about a week and a half of 2025 already under the belt, four companies have already gone public, all small caps, with INLIF Limited (INLF) topping the charts with 15.5% returns thus far.

However, a slew of large-cap companies are expected to IPO this year, many at valuations exceeding $50 billion, including…

Stripe, Medline Industries, Instacart, Zopa, Shein, Databricks, Revolut, Discord, Klarna, StubHub, Reliance Jio, CoreWeave… and a long list of others.

But don’t be fooled by size. Of the twelve companies that went public in 2024 and have returned over 100% thus far… a majority of them, seven, went public at a small-cap valuation…

With small-cap NANO Nuclear Inc. (NNE), being the cream of the entire IPO crop, up 571% as of this writing.

Now, will we see more IPOs in 2025 than 2024?

Will we see more IPO’s beat the S&P 500 this year, than last?

Will small caps continue to be the biggest winners?

Time will tell. But be ready and prepared.

Oh, by the way…

We mentioned earlier how there were 1,143 subscribers to the Dutch East India Company IPO, and at least two of them were servants.

One of the servants was named Neeltgen Cornelis. It’s unknown how exactly how her investment turned out…

But chances are, she did pretty well.