The 2024 IPO market has already exceeded expectations. By June 30, the market experienced 32.7% more debuts than at the same point last year… even as the Fed has kept interest rates at near two-decade highs.[1]

Although we are nowhere near the incredible record -breaking year of 2021 (and are very unlikely to see that many IPOs in a single year anytime soon), chances of a full-on IPO market rebound are gaining steam.

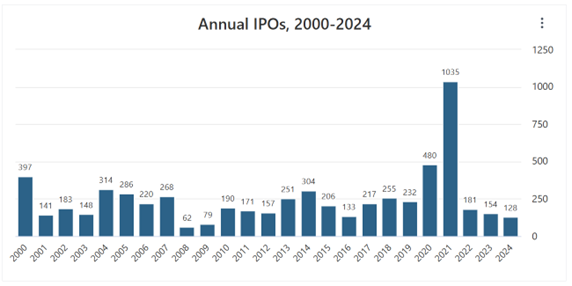

Have a look at this chart. [2]

t shows annual IPOs going back to 2000, including through August of this year. As you can see, and by using a little math, we’re on pace for 192 IPOs by year’s end.

But now, with Fed Chair Jerome Powell signaling the “time has come” for rate cuts, and a majority of economists expecting three quarter-point cuts before the calendar turns to 2025,[3] we may not only see a short-term boost in new listings, but the longer-term “normal” IPO market may get back on track by next year…

Potentially reaching the annual average (going back to the year 2000, excluding 2024) of 223 companies going public per year.

Of course, not every IPO is an instant success, so today, Aether Holdings will share some of the biggest winners and the biggest losers from this year’s IPO market, thus far…

And we’ll show you a great way to better your chances at choosing the right IPOs to invest in, going forward.

So, let’s begin with the first two IPOs of 2024, which also happen to be among the biggest losers and winners of the year.[4]

Roma Green Finance Ltd (ROMA) – down 87% from its January 9 IPO (as of this writing) …

But debuting just two days later, Smith Douglas Homes Corp. (SDHC) is up 74% since its IPO. Of the 15 IPOs in January, ten are trading below their initial offering, with just five trading higher.

The biggest loser of the January list: FibroBiologics, Inc. (FBLG), down 95%. The biggest winner: CG Oncology, Inc. (CGON), up 95%.

On to February…

The biggest loser to debut in February: Vocodia Holdings Corp (VHAI), down 99%…

The biggest winner: BBB Foods Inc. (TBBB), up 82%. Of the 16 IPOs in February, 10 are trading below their initial offering, with 6 trading higher.

March…

There were only 12 IPOs in March, with its biggest loser being Intelligent Group Limited (INTJ), down 77% since its debut. However, the month also offered a big winner: Ryde Group Ltd (RYDE) up 86% since March 6.

April, May and June: With 52 IPOs across this three month span, NANO Nuclear Energy Inc. (NNE) was the clear winner, up 167% since its May 8 debut…

With Neo-Concept International Group (NCI) the clear loser, down 90%.

July and August had 17 IPOs apiece, with Primega Group Holdings Limited (PGHL) besting the list, up 80%… and BloomZ Inc. (BLMZ) worsting the list, down 79%.

There we have it. Of the 129 IPOs thus far, these are some of the best and worst of 2024.

Now, like we said earlier, not every IPO is going to be an instant winner, and some of the new listings of 2024 that are down right now, may rebound… while some that are up right now, may slump…

So, it’s always wise to do some deep research before deciding to invest.

And what better way to obtain well researched, deep and actionable information on stocks (new listings and old) than with SentimenTrader!

You see, with the potential for an IPO boom coming, you’ll want to be well prepared with the best possible information. Information that SentimenTrader offers to help you better avoid “the biggest” losers…

And better your chances at finding the “biggest winners.”

Try SentimenTrader’s 30-day free trial and see what real research can do for you.

[1] What To Expect for the IPO Market in the Second Half of 2024 | Foley & Lardner LLP

[2] IPO Statistics and Charts – Stock Analysis

[3] Fed is predicted to deliver three quarter-point rate cuts this year: Reuters poll | Reuters