Aether Holdings – This Week in FinTech January 30, 2025

DeepSeek Revelation Causes Nvidia to

Shed a Half-Trillion in Market Cap

Chinese AI startup, DeepSeek sent shockwaves through the market after announcing it has created a free, open-source large language AI model to rival ChatGPT (and others).

Notably, the company said its model cost less than $6 million to develop, uses lower capability, less advanced/cheaper NVDA chips in its processing, and has already topped the US download rankings in the Apple app store.

However, OpenAi, the developer of ChatGPT, said on Wednesday it is looking into allegations of IP theft by DeepSeek.

“We know that groups in are actively working to use methods, including what’s known as distillation, to try to replicate advanced US AI models.

“We are aware of and reviewing indications that DeepSeek may have inappropriately distilled our models and will share information as we know more.

“We take aggressive, proactive countermeasures to protect our technology and will continue working closely with the US government to protect the most capable models being built here,” said an OpenAi spokesperson.

As of this writing, NVDA is trading just off weekly lows.

See video, HERE

Tal Cohen, President of Nasdaq on “mission critical”

Fintech infrastructure

Because of its past investments and acquisitions in “mission critical” infrastructure, Nasdaq’s tech is now used by 97% of global systemically important banks, half of the world’s top stock exchanges and 35 central banks and regulatory authorities.

Where is Nasdaq’s technology headed next?

Tal Cohen, President of Nasdaq explains, “We’re looking at everything from issuance and tokenization all the way through to registry and settlement, as we make our way through the energy transition.”

Read more, HERE

Softbank, Oracle, MGX and OpenAI Announce Up to Half-trillion Dollar Investment in US-based Private Sector AI Infrastructure

Up to $500 billion has been committed by big tech titans to launch a US-based Ai infrastructure project called The Stargate Project. In a briefing held by President Trump, he called the project “The largest AI infrastructure project, by far, in history, and it’s all taking place right here, in America.”

The project’s first data center is already underway in Texas and is expected to be completed by year’s end at a cost of roughly $1.1 billion.

But, as Elon Musk pointed out, the project does not have anywhere near $500 billion saying, “They don’t actually have the money. SoftBank has well under $10B secured. I have that on good authority.”

However, companies involved in the project said they already have $100 billion in funding available now, with the rest to come over the next four years.

OpenAi’s CEO, Sam Altman called Stargate, “The most important project of this era.”

Fintech Poised for Major Comeback In 2025

After several years of regulatory scrutiny, unfavorable macroeconomic trends and a plunge in startup valuations, this may be the year Fintech makes a major comeback.

Data from CB Insights show that Q4 2024 fintech funding reached $8.5 billion, up 12% over Q3. In private markets, median pre-money valuations surged by 94.4% last year.

With a new administration that seemingly embraces innovation and favors deregulation, the long-awaited Fintech turnaround may finally be upon us.

According to Forbes, “Another major indicator that we’re headed out of the doldrums is that some of the largest fintech firms, including neobank Chime and Swedish buy now, pay later unicorn Klarna, are finally signaling plans to go public.

“Moreover, this likely points to progress on profitability.”

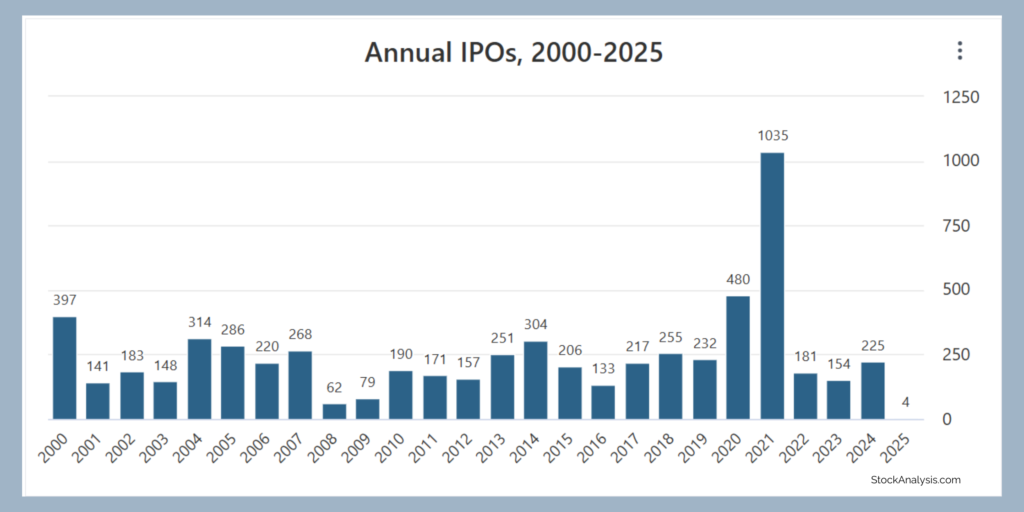

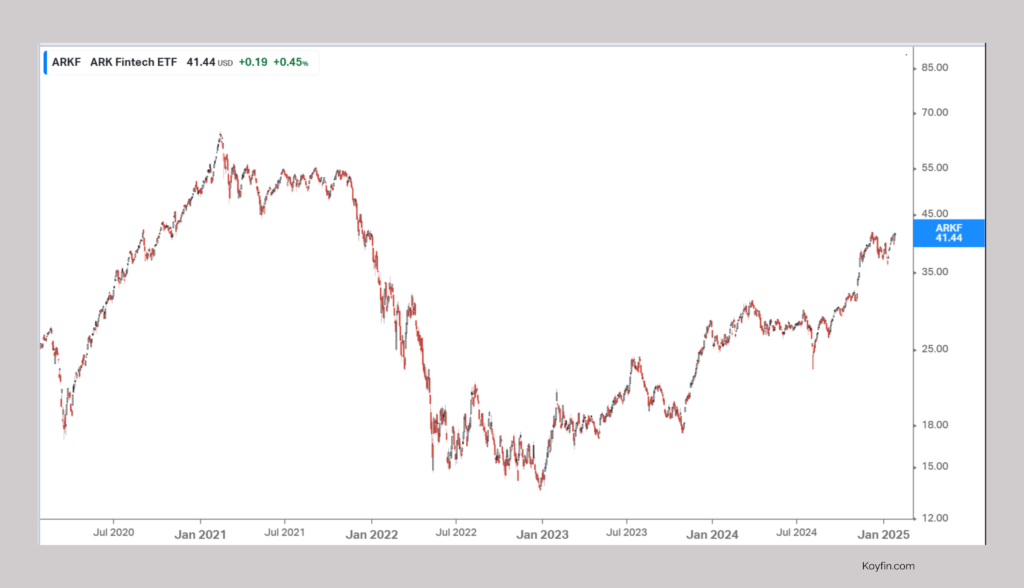

Have a look at this chart…

This is the five-year chart of the ARK Fintech Innovation ETF (ARKF). Although the past two years have not been kind to the industry as a whole…

We’re already in a Fintech bull market (at least ARKF is). So, will 2025 bring new all-time highs to the ETF?

Will individual Fintech stocks and Fintech IPOs boom this year as some suggest?